FRONTEO Holds Online Seminar with Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates × FRONTEO Joint Webinar

Norton Rose Fulbright LLP Webinar Report

December 6, 2022

Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates Webinar Report

January 16, 2023

Overview

◆Date: January 11th, 2023

◆Time: 7:30 - 8:30 PM (ET)

◆Format: Zoom Webinar

◆Fee: Free

※We only accept registrations with company email addresses.

◆Summary:

※We only accept registrations with company email addresses.

◆Summary:

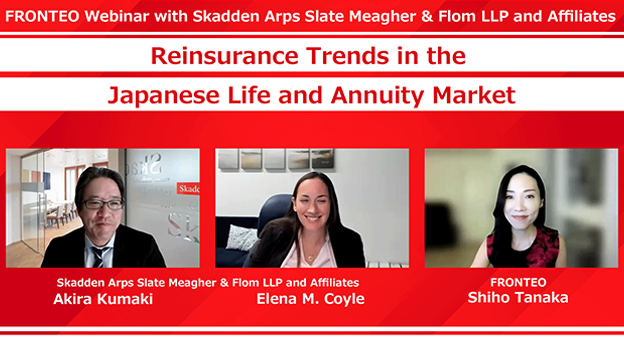

Companies operating or collaborating with others in the United States should be aware of the many shifts in the regulatory landscape with respect to the collection, storage, use, disclosure and processing of personal information, both at the state and federal levels. This webinar highlights various regulatory enforcement actions from the past year, as well as changes to the laws and regulations in the United States, pertaining to personal information. Relevant topics will include updates regarding the status of the California Privacy Rights Act (CPRA), which amends the California Consumer Privacy Act (CCPA), the first enforcement action brought by the State of California under the CCPA, and the rulemaking and enforcement activities of the Federal Trade Commission (FTC) in the areas of privacy and cybersecurity.

◆Agenda:

1. Panelist Introduction

1. Panelist Introduction

7:30 - 7:35 PM (ET) | 9:30 - 9:35 AM (JST)

2. Ken D. Kumayama and Joe Molosky

2. Ken D. Kumayama and Joe Molosky

"Highlights of Regulatory Landscape Relating to Personal Information in the United States"

7:35 - 8:05 PM (ET) | 9:35 - 10:05 AM (JST)

3. Moderated Discussion

7:35 - 8:05 PM (ET) | 9:35 - 10:05 AM (JST)

3. Moderated Discussion

8:05 - 8:20 PM (ET) | 10:05 - 10:20 AM (JST)

4. Audience Q&A

8:20 - 8:30 PM (ET) | 10:20 - 10:30 AM (JST)

8:20 - 8:30 PM (ET) | 10:20 - 10:30 AM (JST)

※The webinar will be conducted in English.

◆Speakers:

Ken D. Kumayama

(Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates)

(Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates)

The Daily Journal has recognized him several times as one of the leading technology lawyers in California, including as a 2022 Top Cybersecurity Lawyer and previously as one of the state’s Top Artificial Intelligence Lawyers. He also has been named

to The Best Lawyers in America. He was a key member of the deal teams that received California Lawyer Attorneys of the Year (CLAY) Awards in recognition of innovative work on behalf of: Livongo Health in its $18.5 billion acquisition by Teladoc Health

(2021), Intel Corporation in its $15.3 billion acquisition of Mobileye, N.V. (2018) and Broadcom Corporation in its $37 billion acquisition by Avago Technologies (2016).

He represents clients in a range of technology and commercial transactions relating to the ownership, protection and exploitation of intellectual property, including IP monetization strategies, development and license agreements, co-development agreements, pharmaceutical collaboration agreements, patent and other technology license agreements, trademark and copyright license agreements, and patent and other intellectual property asset sales and acquisitions. He also counsels clients in a broad range of industries, such as in adtech, fintech and digital health, on cybersecurity- and privacy-related matters, including with respect to the California Consumer Privacy Act, Gramm-Leach-Bliley Act, data rights, and artificial intelligence and machine learning.

In addition to his transactional work, Mr. Kumayama has experience in many other types of patent- and IP-related matters, including investigating and rendering freedom-to-operate, validity and non-infringement opinions; engaging in patent landscape analyses and assessing patent infringement risk; evaluating the strength of, and encumbrances on, patent portfolios; and counseling clients on patent and other strategic IP issues. He is a thought leader in patent analytics and regularly presents on the topic. He also regularly speaks on topics such as patent acquisitions and M&A due diligence. Mr. Kumayama’s pre-law studies, academic research and job experience included theoretical chemistry, geophysics, bioinformatics and system administration of a Linux network, requiring a comprehensive knowledge of mathematics, computer programming (including in C++, perl and FORTRAN) and the sciences. He is fluent in Japanese and worked for more than four years in Japan, both as an attorney at a Japanese law firm and for a Japanese company. He has written about patent monetization and Internet privacy issues and has spoken, in Japanese and English, on topics such as trends in e-discovery and patent exhaustion.

Mr. Kumayama serves as the co-head of the Palo Alto Hiring Committee.

Significant matters in which Mr. Kumayama has been involved include:

Semiconductors

・Entegris, Inc. in its pending $6.5 billion acquisition of CMC Materials, Inc;

・Intel Corporation in its $15.3 billion acquisition of Mobileye, N.V.; its $4.2 billion spin-off and joint venture with TPG Capital, L.P. to form the independent cybersecurity company McAfee; its spin-off of its Wind River subsidiary to TPG Capital, L.P.; its sale of a majority of its smartphone business to Apple for $1 billion; and its sale of its home gateway platform division to MaxLinear, Inc.;

• Coherent in its initially announced $5.7 billion sale to Lumentum, followed by Coherent’s subsequent responses to competing acquisition proposals from MKS Instruments, II-VI and Lumentum in a three-party bidding war culminating in Coherent’s $7.1 billion sale to II-VI;

• NXP Semiconductors N.V. in its $1.76 billion acquisition of Marvell Technology Group Ltd.’s Wi-Fi and Bluetooth connectivity assets;

• Broadcom in numerous transactions, including its $37 billion sale to Avago Technologies Ltd.; its $164 million acquisition of the wireless modem business of Renesas Electronics Corp.; its $195 million acquisition of BroadLight, Inc.; its $3.7 billion acquisition of NetLogic Microsystems, Inc.; its acquisition of Bay Dynamics, Inc.; and in various inbound and outbound technology license agreements;

• Xilinx, Inc. in its $49 billion acquisition by Advanced Micro Devices, Inc.;

• Xperi Corporation in its $3 billion merger of equals with TiVo Corporation and Tessera Technologies, Inc. (now Xperi) in its $850 million acquisition of DTS, Inc.;

• Western Digital Corporation in its data storage and solutions joint venture with Unisplendour Corporation Limited to market and sell Western Digital’s datacenter storage systems in China;

• Advantest America, Inc. in its collaboration with PDF Solutions, Inc.;

• Cavium, Inc. in its $1.4 billion acquisition of QLogic Corp. and its $6 billion acquisition by Marvell Technology Group Ltd.; and

• Cadence Design Systems Inc. in its $170 million acquisition of Jasper Design Automation, Inc.

Technology/Internet

• Activision Blizzard Inc. in its pending $75 billion acquisition by Microsoft Corporation;

• Elon Musk in his $44 billion acquisition of Twitter, Inc.;

• Embracer Group AB in its acquisitions of Dark Horse Media, LLC and Middle-earth Enterprises;

• Dell Technologies Inc. in its $4 billion sale of Boomi to Francisco Partners and TPG;

• Scopely, Inc. in its $1 billion acquisition of GSN Games, Inc. from Game Show Network, LLC;

• Square Enix Holdings Co., Ltd. in the $300 million sale of Crystal Dynamics, Inc., Eidos Interactive Corp. and an IP catalogue to Embracer Group AB;

• Sabre Corporation in its sale of the AirCentre suite of flight and crew management software solutions to CAE Inc. for $392.5 million;

• Zayo Group Holdings, Inc. in several matters, including its $14.3 billion acquisition by affiliates of Digital Colony Partners and the EQT Infrastructure IV fund, the largest media and communications leveraged buyout since the 2008 financial crisis; and its sale of zColo, including certain U.S. and European data center assets, to DataBank Holdings, Ltd.;

• Netflix, Inc. in its acquisitions of Animal Logic, The Roald Dahl Story Company Limited and Scanline VFX;

• Proofpoint in its $12.3 billion sale to Thoma Bravo;

• Honeywell in its pending $1.3 billion acquisition of Sparta Systems from New Mountain Capital;

• Airbnb, Inc. in its acquisition of HotelTonight, Inc.;

• DoorDash in its $410 million acquisition of Caviar from Square;

• Silver Lake Partners in its acquisition of a majority stake in ServiceMax, Inc. from GE Digital LLC;

• F5 Networks, Inc. in its $1 billion acquisition of Shape Security, Inc.;

• Didi Chuxing (Hangzhou Kuaizhi Technology Co., Ltd.) (China) in a strategic software license agreement, and in its acquisition of UberChina from Uber Technologies Inc. The UberChina transaction was named one of China Business Law Journal’s 2016 Deals of the Year;

• Bytedance Ltd. in several matters, including its acquisitions of Musical.ly and Moonton, and private equity financings valued at over $20 billion;

• Apex Technology Co., Ltd. in its $4 billion acquisition of Lexmark International Inc.;

• Samsung Electronics Co., Ltd. in its acquisition of LoopPay, Inc., a mobile payments company;

• XIO Group (Hong Kong) in its $1.1 billion acquisition of J.D. Power and Associates, Inc. from McGraw Hill Financial, Inc.;

• Carbonite in its $1.45 billion sale to OpenText and its $618.5 million acquisition of Webroot;

• Permira Funds in several transactions, including the acquisition and subsequent $1.1 billion sale of its portfolio company Renaissance Learning to Hellman & Friedman; and its significant investment in Curriculum Associates from Berkshire Partners; and

• NDS Group Ltd. and its owners, Permira Funds and News Corp., in its $5 billion sale to Cisco Systems, Inc.

Life Sciences

• Livongo Health in its $18.5 billion sale to Teladoc;

• Stryker Corp. in its:

o $3 billion acquisition of Vocera Communications, Inc.; and

o $4 billion acquisition of Wright Medical Group;

• Alder BioPharmaceuticals Inc. in its sale to Lundbeck for up to $1.95 billion;

• Array BioPharma, Inc. in its $11.4 billion sale to Pfizer;

• Danaher Corporation in the carve-out of its dental supplies unit into a separate publicly traded company called Envista Holdings Corporation via a $589 million initial public offering of common stock;

• Otsuka Pharmaceutical Co., Ltd. in its $430 million acquisition of Visterra, Inc.;

• Ares Life Sciences, a health care-focused private equity fund, in several potential acquisitions;

• Protalix BioTherapeutics in the sale of its Gaucher disease treatment Elelyso to Pfizer; and

• Nitto Denko Corporation in its sale of Aveva Drug Delivery Systems.

Fintech & Financial Services

• Credit Karma in its $8.1 billion acquisition by Intuit and its $50 million divestiture of its tax business, Credit Karma Tax, to Square, Inc.;

• LendingClub Corporation in connection with its acquisition of a national bank and transition to become a bank holding company;

• ZhongAn International in its insurtech joint venture with SoftBank Vision Fund;

• PayPal Holdings, Inc. in multiple transactions, including its $4 billion acquisition of Honey Science Corporation, its $750 million strategic investment in MercadoLibre and its acquisitions of Jetlore, Inc., Hyperwallet and iZettle;

• Visa Inc. in connection with its equity interest in, and contractual relationship with, Prisma Medios de Pago S.A., the leading cards and payments company in Argentina; and its proposed but terminated $5.3 billion acquisition of Plaid Inc.;

• JPMC in connection with its divestiture of the Quorum blockchain platform to ConsenSys and associated agreements;

• JD.com, Inc. in the spin-off of its 68.6% stake in its finance business, JD Finance, and in its Thai e-commerce joint venture with Central Group; and

• Citibank in the sale of its consumer banking and credit card businesses through international auction processes to: Banco Santander Rio S.A. in Argentina; Itaú Unibanco Holding S.A. in Brazil; Scotiabank in Panama and Costa Rica; Promerica Financial Corporation in Guatemala; Banco Ficohsa in Nicaragua; Terra Group in El Salvador; and Banco Colpatria and Bank of Nova Scotia in Colombia.

Strategic Patent Transactions and Counseling

• Nokia Corporation in multiple transactions, including the settlement of its global patent litigation with Apple for $2 billion and the $7.2 billion sale of its devices and services business to Microsoft Corporation;

• RPX in multiple transactions, including its acquisition of patent assets from Rockstar Consortium US LP for $900 million, its acquisition by HGGC for $555 million, and its negotiations with the Japanese patent fund IP Bridge in a syndicated licensing transaction involving 10 member licensees;

• a public semiconductor company in a portfolio-wide cross-license with another public semiconductor company;

• an internet of things consumer products company in multiple transactions, including the licensing, acquisition and monetization of patents and technology;

• IPXI in connection with certain structuring matters and a ULR patent license exchange offering; and

• MIPS Technologies, Inc. in the concurrent sale of patents to an entity formed by the defensive patent aggregator Allied Security Trust and its acquisition by Imagination Technologies Group plc for aggregate consideration of $450 million. The acquisition was named among the top matters in the Lawyers to the Innovators category in the Financial Times’ 2013 U.S. Innovative Lawyers report.

Data Privacy and Cybersecurity Counseling

• Assisting clients across various industries with their California Consumer Privacy Act (CCPA) and Gramm-Leach-Bliley Act (GLBA) compliance programs, including advising on privacy policies and procedures, anonymization and de-identification of personal information, privacy-by-design, security-by-design and other best practices;

• Drafting, negotiating and advising on data processing, data sharing and data transfer provisions and agreements, including in connection with customer and vendor agreements and in the context of machine learning training data sets;

• Advising clients in connection with adtech, direct marketing and online behavioral advertising; and

• Assessing and advising on data privacy and cybersecurity issues with respect to complex, cross-border corporate transactions.

He represents clients in a range of technology and commercial transactions relating to the ownership, protection and exploitation of intellectual property, including IP monetization strategies, development and license agreements, co-development agreements, pharmaceutical collaboration agreements, patent and other technology license agreements, trademark and copyright license agreements, and patent and other intellectual property asset sales and acquisitions. He also counsels clients in a broad range of industries, such as in adtech, fintech and digital health, on cybersecurity- and privacy-related matters, including with respect to the California Consumer Privacy Act, Gramm-Leach-Bliley Act, data rights, and artificial intelligence and machine learning.

In addition to his transactional work, Mr. Kumayama has experience in many other types of patent- and IP-related matters, including investigating and rendering freedom-to-operate, validity and non-infringement opinions; engaging in patent landscape analyses and assessing patent infringement risk; evaluating the strength of, and encumbrances on, patent portfolios; and counseling clients on patent and other strategic IP issues. He is a thought leader in patent analytics and regularly presents on the topic. He also regularly speaks on topics such as patent acquisitions and M&A due diligence. Mr. Kumayama’s pre-law studies, academic research and job experience included theoretical chemistry, geophysics, bioinformatics and system administration of a Linux network, requiring a comprehensive knowledge of mathematics, computer programming (including in C++, perl and FORTRAN) and the sciences. He is fluent in Japanese and worked for more than four years in Japan, both as an attorney at a Japanese law firm and for a Japanese company. He has written about patent monetization and Internet privacy issues and has spoken, in Japanese and English, on topics such as trends in e-discovery and patent exhaustion.

Mr. Kumayama serves as the co-head of the Palo Alto Hiring Committee.

Significant matters in which Mr. Kumayama has been involved include:

Semiconductors

・Entegris, Inc. in its pending $6.5 billion acquisition of CMC Materials, Inc;

・Intel Corporation in its $15.3 billion acquisition of Mobileye, N.V.; its $4.2 billion spin-off and joint venture with TPG Capital, L.P. to form the independent cybersecurity company McAfee; its spin-off of its Wind River subsidiary to TPG Capital, L.P.; its sale of a majority of its smartphone business to Apple for $1 billion; and its sale of its home gateway platform division to MaxLinear, Inc.;

• Coherent in its initially announced $5.7 billion sale to Lumentum, followed by Coherent’s subsequent responses to competing acquisition proposals from MKS Instruments, II-VI and Lumentum in a three-party bidding war culminating in Coherent’s $7.1 billion sale to II-VI;

• NXP Semiconductors N.V. in its $1.76 billion acquisition of Marvell Technology Group Ltd.’s Wi-Fi and Bluetooth connectivity assets;

• Broadcom in numerous transactions, including its $37 billion sale to Avago Technologies Ltd.; its $164 million acquisition of the wireless modem business of Renesas Electronics Corp.; its $195 million acquisition of BroadLight, Inc.; its $3.7 billion acquisition of NetLogic Microsystems, Inc.; its acquisition of Bay Dynamics, Inc.; and in various inbound and outbound technology license agreements;

• Xilinx, Inc. in its $49 billion acquisition by Advanced Micro Devices, Inc.;

• Xperi Corporation in its $3 billion merger of equals with TiVo Corporation and Tessera Technologies, Inc. (now Xperi) in its $850 million acquisition of DTS, Inc.;

• Western Digital Corporation in its data storage and solutions joint venture with Unisplendour Corporation Limited to market and sell Western Digital’s datacenter storage systems in China;

• Advantest America, Inc. in its collaboration with PDF Solutions, Inc.;

• Cavium, Inc. in its $1.4 billion acquisition of QLogic Corp. and its $6 billion acquisition by Marvell Technology Group Ltd.; and

• Cadence Design Systems Inc. in its $170 million acquisition of Jasper Design Automation, Inc.

Technology/Internet

• Activision Blizzard Inc. in its pending $75 billion acquisition by Microsoft Corporation;

• Elon Musk in his $44 billion acquisition of Twitter, Inc.;

• Embracer Group AB in its acquisitions of Dark Horse Media, LLC and Middle-earth Enterprises;

• Dell Technologies Inc. in its $4 billion sale of Boomi to Francisco Partners and TPG;

• Scopely, Inc. in its $1 billion acquisition of GSN Games, Inc. from Game Show Network, LLC;

• Square Enix Holdings Co., Ltd. in the $300 million sale of Crystal Dynamics, Inc., Eidos Interactive Corp. and an IP catalogue to Embracer Group AB;

• Sabre Corporation in its sale of the AirCentre suite of flight and crew management software solutions to CAE Inc. for $392.5 million;

• Zayo Group Holdings, Inc. in several matters, including its $14.3 billion acquisition by affiliates of Digital Colony Partners and the EQT Infrastructure IV fund, the largest media and communications leveraged buyout since the 2008 financial crisis; and its sale of zColo, including certain U.S. and European data center assets, to DataBank Holdings, Ltd.;

• Netflix, Inc. in its acquisitions of Animal Logic, The Roald Dahl Story Company Limited and Scanline VFX;

• Proofpoint in its $12.3 billion sale to Thoma Bravo;

• Honeywell in its pending $1.3 billion acquisition of Sparta Systems from New Mountain Capital;

• Airbnb, Inc. in its acquisition of HotelTonight, Inc.;

• DoorDash in its $410 million acquisition of Caviar from Square;

• Silver Lake Partners in its acquisition of a majority stake in ServiceMax, Inc. from GE Digital LLC;

• F5 Networks, Inc. in its $1 billion acquisition of Shape Security, Inc.;

• Didi Chuxing (Hangzhou Kuaizhi Technology Co., Ltd.) (China) in a strategic software license agreement, and in its acquisition of UberChina from Uber Technologies Inc. The UberChina transaction was named one of China Business Law Journal’s 2016 Deals of the Year;

• Bytedance Ltd. in several matters, including its acquisitions of Musical.ly and Moonton, and private equity financings valued at over $20 billion;

• Apex Technology Co., Ltd. in its $4 billion acquisition of Lexmark International Inc.;

• Samsung Electronics Co., Ltd. in its acquisition of LoopPay, Inc., a mobile payments company;

• XIO Group (Hong Kong) in its $1.1 billion acquisition of J.D. Power and Associates, Inc. from McGraw Hill Financial, Inc.;

• Carbonite in its $1.45 billion sale to OpenText and its $618.5 million acquisition of Webroot;

• Permira Funds in several transactions, including the acquisition and subsequent $1.1 billion sale of its portfolio company Renaissance Learning to Hellman & Friedman; and its significant investment in Curriculum Associates from Berkshire Partners; and

• NDS Group Ltd. and its owners, Permira Funds and News Corp., in its $5 billion sale to Cisco Systems, Inc.

Life Sciences

• Livongo Health in its $18.5 billion sale to Teladoc;

• Stryker Corp. in its:

o $3 billion acquisition of Vocera Communications, Inc.; and

o $4 billion acquisition of Wright Medical Group;

• Alder BioPharmaceuticals Inc. in its sale to Lundbeck for up to $1.95 billion;

• Array BioPharma, Inc. in its $11.4 billion sale to Pfizer;

• Danaher Corporation in the carve-out of its dental supplies unit into a separate publicly traded company called Envista Holdings Corporation via a $589 million initial public offering of common stock;

• Otsuka Pharmaceutical Co., Ltd. in its $430 million acquisition of Visterra, Inc.;

• Ares Life Sciences, a health care-focused private equity fund, in several potential acquisitions;

• Protalix BioTherapeutics in the sale of its Gaucher disease treatment Elelyso to Pfizer; and

• Nitto Denko Corporation in its sale of Aveva Drug Delivery Systems.

Fintech & Financial Services

• Credit Karma in its $8.1 billion acquisition by Intuit and its $50 million divestiture of its tax business, Credit Karma Tax, to Square, Inc.;

• LendingClub Corporation in connection with its acquisition of a national bank and transition to become a bank holding company;

• ZhongAn International in its insurtech joint venture with SoftBank Vision Fund;

• PayPal Holdings, Inc. in multiple transactions, including its $4 billion acquisition of Honey Science Corporation, its $750 million strategic investment in MercadoLibre and its acquisitions of Jetlore, Inc., Hyperwallet and iZettle;

• Visa Inc. in connection with its equity interest in, and contractual relationship with, Prisma Medios de Pago S.A., the leading cards and payments company in Argentina; and its proposed but terminated $5.3 billion acquisition of Plaid Inc.;

• JPMC in connection with its divestiture of the Quorum blockchain platform to ConsenSys and associated agreements;

• JD.com, Inc. in the spin-off of its 68.6% stake in its finance business, JD Finance, and in its Thai e-commerce joint venture with Central Group; and

• Citibank in the sale of its consumer banking and credit card businesses through international auction processes to: Banco Santander Rio S.A. in Argentina; Itaú Unibanco Holding S.A. in Brazil; Scotiabank in Panama and Costa Rica; Promerica Financial Corporation in Guatemala; Banco Ficohsa in Nicaragua; Terra Group in El Salvador; and Banco Colpatria and Bank of Nova Scotia in Colombia.

Strategic Patent Transactions and Counseling

• Nokia Corporation in multiple transactions, including the settlement of its global patent litigation with Apple for $2 billion and the $7.2 billion sale of its devices and services business to Microsoft Corporation;

• RPX in multiple transactions, including its acquisition of patent assets from Rockstar Consortium US LP for $900 million, its acquisition by HGGC for $555 million, and its negotiations with the Japanese patent fund IP Bridge in a syndicated licensing transaction involving 10 member licensees;

• a public semiconductor company in a portfolio-wide cross-license with another public semiconductor company;

• an internet of things consumer products company in multiple transactions, including the licensing, acquisition and monetization of patents and technology;

• IPXI in connection with certain structuring matters and a ULR patent license exchange offering; and

• MIPS Technologies, Inc. in the concurrent sale of patents to an entity formed by the defensive patent aggregator Allied Security Trust and its acquisition by Imagination Technologies Group plc for aggregate consideration of $450 million. The acquisition was named among the top matters in the Lawyers to the Innovators category in the Financial Times’ 2013 U.S. Innovative Lawyers report.

Data Privacy and Cybersecurity Counseling

• Assisting clients across various industries with their California Consumer Privacy Act (CCPA) and Gramm-Leach-Bliley Act (GLBA) compliance programs, including advising on privacy policies and procedures, anonymization and de-identification of personal information, privacy-by-design, security-by-design and other best practices;

• Drafting, negotiating and advising on data processing, data sharing and data transfer provisions and agreements, including in connection with customer and vendor agreements and in the context of machine learning training data sets;

• Advising clients in connection with adtech, direct marketing and online behavioral advertising; and

• Assessing and advising on data privacy and cybersecurity issues with respect to complex, cross-border corporate transactions.

Joe Molosky

(Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates)

(Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates)

Joe Molosky is a lead associate of the Skadden team advising on matters related to cybersecurity, privacy and sensitive technology. He counsels clients on a variety of transactional and regulatory matters, including cross-border transactions, regulatory

proceedings, and privacy and cybersecurity issues. Mr. Molosky’s practice focuses on national security reviews before the Committee on Foreign Investment in the United States (CFIUS), cybersecurity compliance and incident response, data

privacy, national security and consumer protection issues, as well as internal and government investigations.

Mr. Molosky assists clients in obtaining clearances from CFIUS for mergers, acquisitions and investments, and advises clients on the potential national security risks of proposed transactions. He also assists in responding to data breaches and cybersecurity incidents, including representing clients in government investigations resulting from these incidents, as well as in advising on the adequacy of clients’ privacy and cybersecurity practices and the development of comprehensive privacy and cybersecurity programs.

Representative experience includes:

• Boston Dynamics, Inc. in Hyundai Motor Group’s acquisition of an 80% stake from SoftBank Group Corp.;

• SK hynix, Inc. in its $9 billion acquisition of the NAND memory and storage business of Intel Corporation;

• Centene Corporation in response to a cybersecurity attack on a vendor involving the exposure of confidential information belonging to members of the insurer Health Net, Inc., a subsidiary of Centene, and in a lawsuit against that vendor to recover damages from the incident;

• Mediant Communications Inc. in the forensic investigation and engagement with regulators in response to a cybersecurity incident;

• Bending Spoons S.p.A. in its $260 million bid to acquire Grindr LLC;

• Cavium, Inc. in its $6 billion acquisition by Marvell Technology Group Ltd.;

• DSV Panalpina A/S in its $4.2 billion acquisition of the Global Integrated Logistics business of Agility Public Warehousing Company K.S.C.P.;

• Hg 7 Fund in the sale of Sovos Compliance, LLC to Hg Saturn 2 Fund and TA Associates Management, L.P.;

• Toshiba America Energy Systems Corporation in its $40 million acquisition of the EtaPRO business of GP Strategies Corporation;

• Xilinx, Inc. in its $35 billion acquisition by Advanced Micro Devices, Inc.; and

• a Chinese technology company in connection with a CFIUS review of its acquisition of a social media app.

Mr. Molosky maintains an active pro bono practice, including representing individual clients in housing and property tax matters. He also serves on the Young Professionals Board of the Lawyers’ Committee for Better Housing.

Mr. Molosky assists clients in obtaining clearances from CFIUS for mergers, acquisitions and investments, and advises clients on the potential national security risks of proposed transactions. He also assists in responding to data breaches and cybersecurity incidents, including representing clients in government investigations resulting from these incidents, as well as in advising on the adequacy of clients’ privacy and cybersecurity practices and the development of comprehensive privacy and cybersecurity programs.

Representative experience includes:

• Boston Dynamics, Inc. in Hyundai Motor Group’s acquisition of an 80% stake from SoftBank Group Corp.;

• SK hynix, Inc. in its $9 billion acquisition of the NAND memory and storage business of Intel Corporation;

• Centene Corporation in response to a cybersecurity attack on a vendor involving the exposure of confidential information belonging to members of the insurer Health Net, Inc., a subsidiary of Centene, and in a lawsuit against that vendor to recover damages from the incident;

• Mediant Communications Inc. in the forensic investigation and engagement with regulators in response to a cybersecurity incident;

• Bending Spoons S.p.A. in its $260 million bid to acquire Grindr LLC;

• Cavium, Inc. in its $6 billion acquisition by Marvell Technology Group Ltd.;

• DSV Panalpina A/S in its $4.2 billion acquisition of the Global Integrated Logistics business of Agility Public Warehousing Company K.S.C.P.;

• Hg 7 Fund in the sale of Sovos Compliance, LLC to Hg Saturn 2 Fund and TA Associates Management, L.P.;

• Toshiba America Energy Systems Corporation in its $40 million acquisition of the EtaPRO business of GP Strategies Corporation;

• Xilinx, Inc. in its $35 billion acquisition by Advanced Micro Devices, Inc.; and

• a Chinese technology company in connection with a CFIUS review of its acquisition of a social media app.

Mr. Molosky maintains an active pro bono practice, including representing individual clients in housing and property tax matters. He also serves on the Young Professionals Board of the Lawyers’ Committee for Better Housing.

Vlad Lobatchev

Director of Engagement Management and Data Science

(FRONTEO USA)

As an Engagement Manager and a Director of Data Science and Strategy, Vlad Lobatchev is responsible for ensuring that our clients always receive top-tier customer experience and best-in-breed technology to enhance their e-Discovery workflows. He draws on his extensive professional experience and legal background to guide development and implementation of innovative technological solutions and workflows on client engagements. Prior to joining FRONTEO, he was an attorney for two years specializing in general corporate and finance law – taxation, contracts, corporate formation, and administration.

(FRONTEO USA)

As an Engagement Manager and a Director of Data Science and Strategy, Vlad Lobatchev is responsible for ensuring that our clients always receive top-tier customer experience and best-in-breed technology to enhance their e-Discovery workflows. He draws on his extensive professional experience and legal background to guide development and implementation of innovative technological solutions and workflows on client engagements. Prior to joining FRONTEO, he was an attorney for two years specializing in general corporate and finance law – taxation, contracts, corporate formation, and administration.

◆Moderator:

Shiho Tanaka

Shiho Tanaka

SVP, Discovery Consulting Division (FRONTEO USA)